As traditional communication patterns in different spheres are becoming less relevant, mobile phones are becoming tools that are widely used for banking, payment and shopping. Mobile financial services are a new fast-evolving sector that has expanded its intermediary role between customers and retailers, financial services providers, etc. According to the survey of the Federal Reserve Board 87% of the adult population in the USA has a mobile phone. While Gartner predicts that mobile phone sales to end users will increase to 1.9 billion units in 2014 (the Gartner’s forecast for 2018 is 2.1 billion units), eMarketer expects 4.55 billion people worldwide to use a mobile phone in 2014.

It cannot but affect mobile financial services development in an impressive way. Thus, Gartner says that by 2018, revenue from mobile services will grow to $1.2 trillion and the number of mobile connections will reach 8.5 billion – fostered by uptake of mobile data cards, connected devices in mature markets, and organic growth in emerging markets. IT companies are doing their best to keep pace along with these figures. That is why currently lots of efforts are directed at IT activity concentration on the best practices. What do we get if we add the statistics on the mobile phones use to mobile financial services? At Elinext Group, we suggest that the following mobility trends are worth mentioning:

1. Improved access to mobile financial services

The majority of customers have near-constant access to their mobile phones that provide just-in-time information which affect financial decision-making. Thus, point-of-sale services continue to grow due to innovative access to them. Currently, mobile phones offer new capabilities for a retail purchase at merchant locations. As a result, a tremendous growth in using mobile phones occurs when people want to scan a barcode or get a quick response code at the cash register. These are the most popular mobile payments in the USA. Between 2012 and 2013, in the USA the share of people who reported making a POS purchase with their Smartphone in the past 12 months has risen from 6% of Smartphone users in 2012 to 17% of such users in 2013 (Source: Survey of the U.S. Federal Reserve Board).

In general, Gartner forecasts that the worldwide mobile payment market will have over 450 million users and a transaction value of more than $721 billion in 2017. This represents compound annual growth rates of 18% and 35% respectively for the period 2012 to 2017. An improved access is this very area that customers have found while using mobile financial services. 37% of the respondents surveyed by the Federal Reserve Board started using mobile payments due to their convenience. The same applies to mobile banking, the second sector of the mobile financial services.

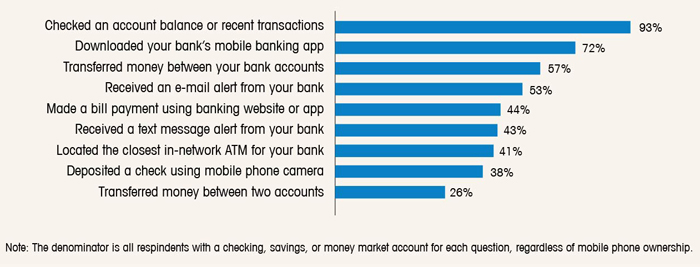

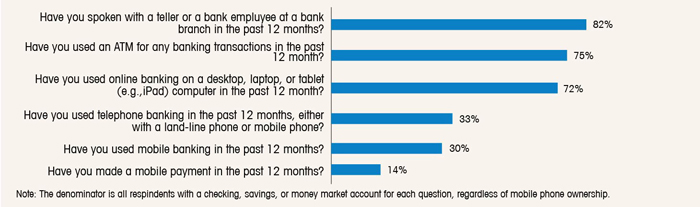

Figure 1. Use of different access to banking services, 2013, USA, survey of the Federal Reserve Board

Modern mobile banking apps feature a wealth of capabilities including funds transfer, remote deposit capture, personal financial management, bill payments, as well as debit card functionality. 69% of the mobile banking users surveyed have checked their balance before making a large purchase in 2013 and half of them didn’t buy an item as a result of their account balance or credit limit (Source: Survey of the U.S. Federal Reserve Board). Actually, checking financial account balances or other transactions inquiries followed by money transferring between accounts remain to be the most common mobile banking activities in the U.S. and Europe.

Remark: in the United States the convenience of the mobile banking overtook Smartphone adoption as the driving force behind the use of mobile banking (37% against 32% respectively).

2. Comparing the above-mentioned mobile payments and mobile banking, the common trend to be named is that the use of mobile payments is still less common than the use of mobile banking

In the United States among all Smartphone owners surveyed in 2014, 30% made an online purchase using their phone in the past 12 months, 24% paid bills online, 17% paid for a product or service at a store, 15% transferred money directly to another person’s financial account, and 12% received money from another person. Far less common was a payment by text message 5% or paying for parking or a taxi 4%.

Comparing the use of mobile banking and mobile payments it should be mentioned that while, as we have put it earlier, the use of mobile banking is connected with transactions inquiries, and these are considered to be less « dangerous » (there’s no secret that many consumers express their concern about security of mobile banking and mobile payments. Despite an increase in the usage of these mobile financial services a significant number of customers consider them to be unsafe).

3. Increased simplicity of mobile financial services.

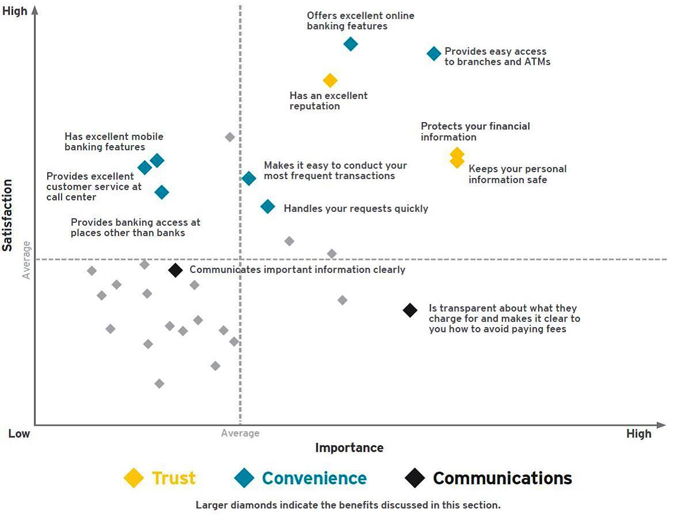

The introduction of mobile technologies for financial organizations has resulted in an influx of new customers seeking basic financial services. The simplicity of the mobile financial services has to do with clear communication with customers and an access to services in the way they prefer. Difficult things can be made and explained in a simple way.

This area was mentioned by the majority of the respondents of the Ernst and Young’s « Global consumer banking survey-2014 » conducted in 43 countries in 2014. To gain a deeper understanding of the attributes that customers value in financial services, survey respondents were presented with 31 benefits asked to select top 5 of them.

Mobile banking ranks are lower in comparison with online banking, probably because of mobile’s relatively recent integration as a channel. Customers expect that everything they can do online can be done on their mobile device, but these improvements are still catching up at many banks.

On the whole, customers expect simplicity. Mobile financial services tend to be very customer-centric. And this is one of the most sought-after benefits that was named by the majority of 32 642 respondents in 43 countries according to the Ernst&Young’s report.

Following the trend, recently at Elinext Group we have taken development of an app that is aimed to replace many transactions with interactive financial graphs that will eliminate complexity of borrowing or lending money named LoanGarage App. Elinext Group has also recently released an FX Grant platform for Forex traders with different levels of experience .

4. Mobile financial services tend to provide their customers with advice and seamless information. This is, actually, a real-time need for mobile financial services to be profitable and successful.

Besides, we can definitely talk here about different levels of the information. Thus, 34% of the U.S. consumers surveyed report that they are interested in using their phones as a means to compare prices while shopping. The expressed interest also has to do with discount offers management, getting offers etc. The information provided affects shopping behavior. Due to mobile capabilities consumers can scan a Quick Response code in newspapers, magazines or advertisements to get product data, apart from doing it directly in a retail store.

Going to a higher information level, the most widespread thing here is that consumers of mobile financial services get a wide range of text alerts (low-balance alerts, payment due alerts, deposit alerts, fraud alerts, credit card balance alerts, saving reminders). These data encourage a person to engage into the right financial behaviors that is beneficial both for them and financial institutions.

This statement is proved by the results of the Ernst &Young’s research on global consumer banking-2014: to be more specific, customers say they are ready to involve mobile interactions as well as other interaction channels in exchange for financial and problem-solving advice. More than 70% of respondents said they would consider buying additional products from their financial providers if advisory services were improved. That is why we can absolutely declare that mobile capabilities should be built around this need for advisory service.

5. Use of mobile financial services highly depends on age.

18-35-years-old are increasingly favoring mobile capabilities.

| Upwardly Mobiles | Elites | New World Adopters |

Safety Seekers | Unhappy and Unmovings | |

| Branch or office | 46 % | 23% | 27% | 27% | 18% |

| Call Center | 34% | 10% | 17% | 12% | 11% |

| ATM | 76% | 61% | 63% | 57% | 50% |

| Online/Internet | 79% | 79% | 67% | 45% | 45% |

| Mobile | 69% | 34% | 48% | 26% | 17% |

| Remote channel average (ATM, online, mobile) | 75% | 58% | 59% | 43% | 37% |

Figure 4. Channel use, financial services. Ernst&Young’s global consumer banking survey-2014. 43 countries, 32 642 respondents. Population groups here are given partially in comparison with the research.

In the upper horizontal row one can see categories of consumers (« upwardly mobiles, elites, new world adopters » etc.). Here one should stress that according to Ernst&Young divisions « upwardly mobiles », « new world adopters », « safety seekers » are younger consumers (in comparison with older « self-sufficient », « traditionalists » and so on). Among them, we can see a high percentage in the use of mobile services. The same applies to the U.S.

Among aged 18-29 surveyed there are approximately 39% of mobile banking users (21% of mobile users respectively). Individuals between 30 and 44 account for 34% of mobile banking users. The same situation concerns mobile payments:

| Age Category | Yes, % | No, % | Total, % |

| 18-29 | 18.9 | 35.7 | 21.8 |

| 30-44 | 25.3 | 32.6 | 26.6 |

| 45-59 | 28.6 | 21.4 | 27.4 |

| 60+ | 27.2 | 10.4 | 24.3 |

| Number of respondents | 1, 956 | 372 | 2,328 |

Figure 5. Use of mobile payments by age, USA, 2013

6. Use of mobile financial services highly depends on countries.

As described above, high-developed countries favor mobile financial services development to a larger extent. Developing countries are behind for different reasons. The World Economic Forum experts studied mobile financial services markets in Argentina, China, Uganda, Brazil, Afghanistan, Bangladesh, South Africa, Mexico, India, Colombia, Haiti, Ghana, Peru etc., in other words, countries with major differences. However, it turned out that many common concepts and insights also apply to all of them.

According to the report, the obstacles that impede the progress of mobile financial services in developing countries span a wide array of issues: lack of experience resulting in mistrust toward official institutions, lack of infrastructure and information, poor population and inadequate customer service etc. All the constraints were divided into groups; as a result, mobile financial services in developing countries need some concentrated pillars such as:

- proper regulatory environments (law, financial, telecommunication sectors)

- a proper basis for consumer protection

- market competitiveness

- market catalysts (including government support)

- proper end-user environments (mobile penetration, financial literacy of population)

- distribution and agent network

- adoption and availability of mobile capabilities.

In 2009, according to Financial Access Initiative, access to financial services was limited for 2.5 billion people (mostly poor countries).

The above mentioned research states a not much better situation. Meanwhile, financial analysts say that the poorer a household is, the stronger its need for such financial services as savings, credit and insurance. That is why overcoming the 7 constraints means a lot for realization of potential of mobile financial services in developing countries of Latin America, Africa and Asia.

To sum it all up, we suggest that use of mobile phones to deliver financial services represents unprecedented opportunities for the world economy, serving as a universal time-saving platform in Western countries and providing stability in developing economies. That is why mobile financial capabilities are becoming a kindly field for high technologies.

Elinext mobile application projects:

Financial and accounting software

nPassword

SUCCESSplaner

METANeconomics

Industries and Technology Areas:

Industries: software development

Technology Areas: mobile application development, software development, custom software development, iOS, Android