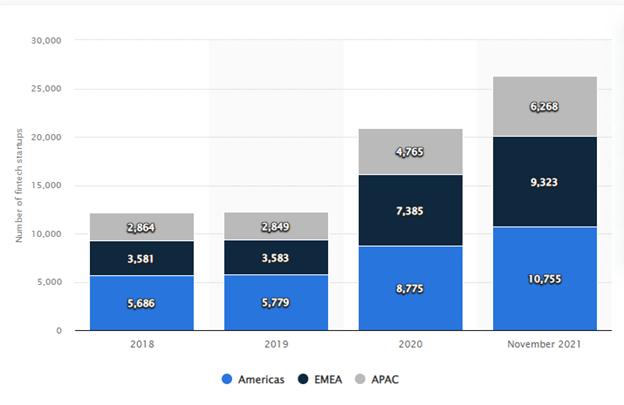

In 2021, the number of fintech startups amounted to more than 26,000 worldwide, growing triple digits over the last two years. Global fintech investments are also an all-time high, skyrocketing by 169% from 2020 to a whopping $131.5 billion in 2021. From digital payments and e-wallets to peer-to-peer lending and robo-advisors, consumers readily adopt financial technology to simplify their day-to-day life.

Source: Statista

Although technological progress and innovations continue to drive the financial transformation forward, fintech businesses face a unique set of risks and exposures that may differ from traditional financial institutions. We have rounded up the top five risks to watch out for in 2022.

Technology vulnerability

Platform or technology malfunctions or vulnerabilities can have adverse impacts on consumers, varying from poor customer service to financial losses. For example, if a payment transaction is not processed in a timely manner, customers may incur additional charges or fees. Any service instability or downtime can lead to lost profits and reputational damages.

How to address technology risks:

- Technical due diligence of a fintech development service provider;

- End-to-end testing and quality assurance to make sure your service is reliable, responsive, and always available;

- Ongoing maintenance and reliable SLA support.

Cyber attacks and data breaches

In the fintech space, cybersecurity and data privacy play a pivotal role in driving adoption and winning customers’ trust. Fintech solutions have access to a user’s sensitive data and personally identifiable information like social security number, account number, identity data and card data.

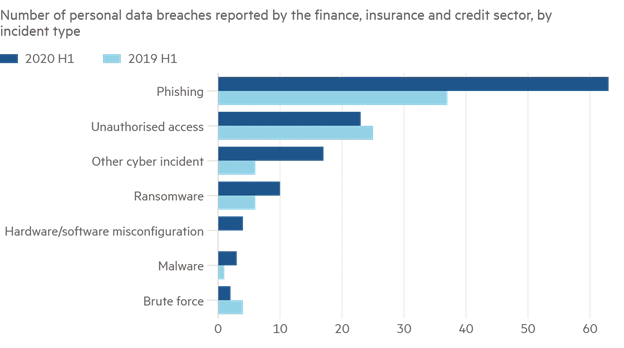

But in 2020, financial services and insurance sectors were top attacked industries globally, according to an IBM report. Last year Cashalo, a Philippines-based online lending platform, suffered a data breach that resulted in the leak of 3.3 million customer data records. During the Covid-19 pandemic, cyber-attacks at financial companies have spiked.

Source: Investors’ Chronicle

How to mitigate cybersecurity risks:

- Implement adequate technical security controls like multi-factor authentication, roles and access management, end-to-end encryption, etc — 75% of high-level threats could have been avoided with proper protection measures;

- Perform penetration testing and vulnerability scanning, as well as regular security audits;

- Continuously monitor network traffic to identify suspicious activity or attempts of unauthorized access.

Fairness and computational bias

Innovative fintech solutions leverage new, non-traditional types of data and artificial intelligence to guide their decisions. But as AI-powered algorithms become ingrained into their operations, a new type of risk occurs called algorithmic bias. Algorithmic bias refers to a phenomenon when machine learning algorithms produce an unfair or subjective outcome. This bias can creep into algorithms in different ways depending on who developed them and what input data was used.

A vivid example was the first international beauty contest judged by AI. Out of 6,000 participants, the algorithm selected 44 winners who, to the organizers’ surprise, were mainly white, with a handful of Asians and one with dark skin. Another case came from Amazon when the tech giant had to stop using its recruiting algorithm because it showed bias against women. The algorithm favored more “masculine” language and favored candidates who used the words “executed” and “captured” that were more commonly found on male engineers’ resumes.

Fintech algorithms can be subject to bias, too. For example, to provide a credit score decision, lending applications use a myriad of data points like occupation, educational background, and even social connections. An algorithm can be programmed to favor applicants from certain colleges but if the admission process in those colleges discriminates against certain groups of people, this bias can further be translated into credit decisions of a lending app.

How to mitigate computational bias risk:

- Ensure transparency into what variables are taken into account for the decision model;

- Leverage techniques like adversarial de-biasing and dynamic unsamplic of training data to mitigate bias;

- Test your algorithmic models and continuously monitor the outcomes to identify potential errors.

Regulatory non-compliance

Another major challenge for fintechs is to keep up with evolving regulations and rules as non-compliance results in hefty penalties and legal actions. Ripple Labs, a San Francisco-based fintech company, was slapped with a $700,000 fine for failure to implement adequate anti-money laundering (AML) provisions.

In addition to AML, there are many other regulations that fintech companies must comply with, including Know Your Customer (KYC), Payment Card Industry Data Security Standard (PCI-DSS), Fair Credit Reporting Act (FCRA), General Data Protection Regulation (GDPR), and more. In fact, fintech regulations around the world differ from country to country, with UK, UAE, and Singapore being among top-rated countries with their own regulatory sandboxes. But although the regulatory landscape is very complex, fintech startups often do not have the resources to establish an internal compliance function — almost a quarter of fintech companies do not have a designated Chief Compliance Officer.

How to mitigate regulatory risks:

- Implement strong regulatory management and compliance program as well as internal controls;

- Perform periodic compliance audits;

- If you don’t have the resources or expertise, outsource the compliance management function to a third-party service provider.

Unforeseen market events

Unpredictable events are also a major operational risk for fintechs since the financial market is known to overreact to news and sudden flukes, which may result in serious liquidity and solvency problems. One of such events was the Covid-19 pandemic that caused many fintech businesses to re-strategize or even shut down. ScaleFactor, a fintech startup that raised $100 million in funding, had to wind down after the pandemic wiped out the demand for its product from small and medium-sized businesses.

Recent Russia’s invasion of Ukraine was another unforeseen event that had a significant economic and geopolitical fallout. A wide range of sanctions that followed posed a significant risk for financial institutions and caused a massive shift in the regulatory landscape. For instance, to comply with the restrictive measures, fintech companies must revisit their AML and KYC procedures, direct and beneficial ownership due diligence processes with an eye to potential loopholes and blindspots.

How to mitigate the risk of unpredictable market events:

- Diversify your customer base to avoid excessive reliance on a single client segment or geographic area;

- Political risk insurance can help protect your fintech business against such acts as strikes, confiscations, war, trade embargoes, etc.

Wrapping up

With the average adoption rate of 64%, fintech has finally become mainstream. According to Market Data Forecast, the global fintech market is expanding and is expected to reach $324 billion, growing at an impressive CAGR of 25.18%. The success of fintech lies in the fact that they effectively address customers’ pain points and frustrations, from streamlined mobile payments to easier access to online loans to simpler personal wealth management tools.

But like in any industry, there are certain challenges that fintech businesses have to face. Technology reliability, data privacy, and security, as well as regulatory compliance remain top concerns in 2022. Computational bias of underlying algorithms and unpredictable market events too are on the fintech’s risk radar. And although these risks are unavoidable, they are also manageable, with a balanced approach and careful planning.

Do you have an idea for a fintech project in mind? Leverage our multi-year financial apps development expertise to build a custom fintech solution that would be a good market fit.