Paying online has become a one-click action. The number of online transactions and requests to the banks is growing exponentially. People prefer to open a bank account online instead of wasting time physically going there.

The market for online banking, or so-called neobanks, is experiencing a sharp growth at a CAGR of 47.7, reaching a projected value of 722.6 billion U.S. dollars in 2028.

But how much easier and more profitable is it to open a neobank? Which risks does the owner face during the development process?

Rb.ru asked Dmitry Salatov, co-founder of the Blanc neobank about that, and we are publishing the translation of his story. The link to the original article in Russian is at the end of the article.

Dmitry Salatov

Marketing director at « Blanc » ― the bank for entrepreneurs.

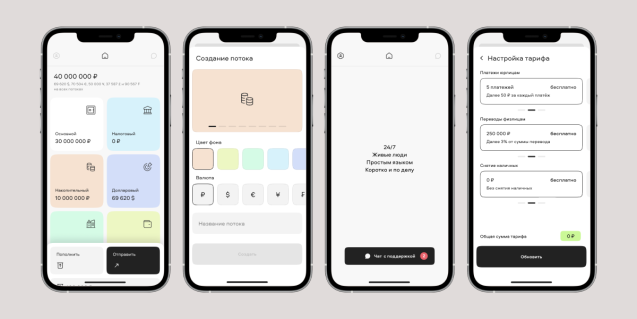

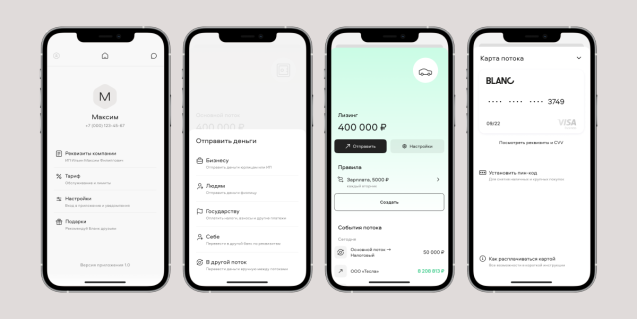

The creators of the Blanc bank see the main advantage of their service in the refusal to be tied to a bank account and the transition to financial flows. Inside the application, an entrepreneur can set up a rule that will be used to distribute incoming money according to any scheme. For example, flows can automatically set aside a fixed amount every month, week, or every day for office rent, take a percentage of incoming tax revenue or a new car, etc.

Completely different bank

We wanted to create a bank that would be different from the already existing solutions. We have been working in this niche for a long time. So we were aware of the weaknesses of most modern banks. And we wanted to avoid these weaknesses in our product:

- inconvenient mobile applications

- high and non-transparent rates

- not very client-friendly support

Within a few months, we managed to implement a different approach to banking based on several key principles:

Mobile First

A smartphone is enough for a client to manage his or her funds. In many banks, the mobile application is reduced in functionality compared to the desktop version. We did the opposite – all functionality is available from mobile devices. There is no need to connect or confirm anything from laptops or desktop PCs.

Financial flows to simplify the work with money

This approach allows bringing business expenses directly to the main screen of the mobile application. It also allows clients to automate their distribution using simple rules.

Communication with clients in a « human » language without robots or neural networks

Entrepreneurs face unusual situations every day. A chatbot cannot be taught to react to all of them. We decided to deploy « human » support that helps entrepreneurs without intermediaries.

Tariff constructor

Every client can independently choose the number of payments, withdrawal limits, and cash withdrawals for their business.

Investments

To open a neobank, millions of dollars are required. In Russia, it’s quite difficult to attract such large investments because you need to show future profits immediately. Also, most investors look carefully at the specifics of the market and the team.

In our case, all the Blanc founders are former top managers, each with more than 10 years of experience in the banking sector. So it was not difficult for us to prove our expertise in the market.

For the launch of our fintech startup, we managed to raise capital of 1.226 billion RUR, which is the amount we initially expected. This became possible because the budget project was convincing for the investor. We based our calculations on various parameters, including the most important one – LTV (Lifetime Value): the cost of attracting a client should not exceed a third of his LTV.

This is a normal indicator for a startup, quite realistic. It is a bad idea to make overly optimistic development plans for a neobank: they give the investor false confidence in the imminent profit and, if something goes wrong, lead to him feeling cheated.

Good planning

It was critically important for us to plan the approximate budget of the project, the allowable cost, as well as the period after which we will start earning and not just spending.

We immediately decided that it will be better to make a realistic plan with the minimum amount of work and tasks required. At the same time, achieving more than was expected according to plan is always a plus: it has a positive effect on investors, they are more willing to participate in the new rounds.

We described only what we were sure of: conducted a detailed analysis of the market and competitors, presented a portrait of our future client, and considered what is generally required to launch a bank.

It was important to spend no more than six months on the launch. There was simply no other option for us. We needed to show the potential for further development of the project.

Strategy Development

The next step was developing a strategy. We conducted deep Customer Development and several sessions on design thinking. The strategy included not only what we are going to do, but also what we will definitely not do.

For example, at the very beginning we decided that in the first year after the launch we will not develop a web version of the bank, but only a mobile application.

We understood that most banks developed their services five or six years ago, so their products are based on the web version. But during this time, user behavior has changed. Today interaction with banks takes place mainly through smartphones and mobile applications.

We decided to take a risk by launching the first bank in Russia without a web version – and we won! The benefit is that we have saved a lot of resources, including developers’ efforts, finances, and time. Working in two directions at once – the web and smartphones – is a double burden for a startup.

We also have abandoned the server infrastructure, opting for a completely cloud-based option. We became the first bank in Russia where services are based exclusively on a cloud platform, without physical servers. This also helped us a lot to achieve the main goal – to launch Blanc in six months.

And lastly, we deliberately decided not to implement the widest possible functionality, but to focus on what is most important for bank customers. And it also worked – we began to develop rapidly, clients noticed us, clients began to talk about us.

Required resources

We had to decide on the resources that are needed at the initial stage when planning such a rapid launch (the average launch time for digital banks is a year or more). As a result, we settled on several obligatory points:

Team

We didn’t have much of a problem here. We knew the market well and understood how to assemble the backbone of the team. It took two months out of six to hire about 70 people. Employees were mainly recruited based on recommendations and through social networks (primarily Facebook). The traditional search through the HeadHunter portal helped less.

Key employees work in the office. It helps to establish all the necessary processes. The rest work either by a hybrid model (partly in the office, partly remotely) or completely remotely.

Outsourcing

It would be impossible to cope without third-party specialists. Too much work had to be done in a short time. The best option was to hire key specialists who, in turn, were responsible for outsourcing: they knew all the contractors and independently interacted with them.

This approach made it possible for us not to hire a huge number of employees, but to get by with a relatively small onboard team.

We didn’t outsource customer support and the compliance system. These are key elements for businesses where the quality of service is of fundamental importance. Therefore, the selection of support staff and the compliance system had to be approached especially carefully.

Ready-T-Use Products

There is no need to reinvent the wheel when there are a lot of ready-to-use products. For example, a chat module for the application (of course, we have greatly improved the original product), as well as data storage systems from Yandex, a system for setting and controlling internal tasks, the workflow, etc.

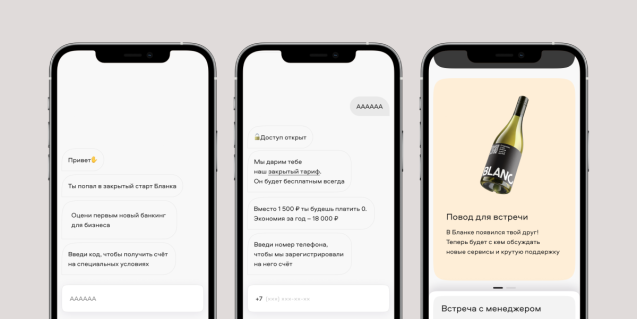

Launch and invitation system

Before becoming available for everyone, Blanc was only available via an invitation. This lasted for 1,5 months. To start working with the bank, a new client had to be invited by one of the existing users. Each of the co-founders distributed 100 invitations to their acquaintances and friends. With the invitation, five more invites were issued, which everyone could provide to their own acquaintances. And it worked – the number of users began to increase rapidly.

This became our special feature and part of the strategy to attract the first customers, and at the same time allowed us to ensure a smooth launch and gain time to prepare the entire infrastructure for a larger number of users (for example, 10 thousand).

The result was a kind of Clubhouse effect when the invite system greatly contributed to the popularization of the service. Thanks to the « closed » launch by invites, we already had three thousand open accounts and 10 thousand app installations. Our idea worked: without showing the product to the market, we achieved excellent results in attracting customers. (About half of what top five banks in Russia show – on average 5 to 15 thousand new customers per month).

Checklist for a Quick Launch

- Attractive offer for investors. They need to know the team members as well as understand the idea and its relevance to the market.

- Calculation of the basic unit economy. It should be clear and transparent so that potential partners can be sure that it makes sense to invest in the project.

- Creation of a financial model, including at least an approximate budget for the project, the allowable amount of financial costs, and the period for reaching profit.

- Strategy. CustDev and design thinking sessions. At this stage, it is important to decide what you are planning to add to the offer for customers in the first place, and what not.

- Resources. The basic minimum is a team, proven contractors capable of quickly outsourcing tasks, as well as a selection of ready-made services that can be taken from outside (open source or licensed) and implemented in the main product.

- Launch. There are two ways here: either make a big statement about yourself with a big marketing budget or attract the first customers in some other way. For example, organize a system of invites, as we did.

The original article in Russian is available at https://rb.ru/opinion/how-to-open-digital-bank/