Banking is a traditionally conservative sector. However, lately, it has been experiencing massive digital transformations. In the upcoming 2022, this is especially true for mobile banking services. During 2020 and 2021 mobile banking grew tremendously: according to Insider Intelligence, it has been growing at five times the rate of online banking. As much as half of all online customers are also mobile banking users and mobile payments are expected to grow at a compound annual growth rate of 29.0% between 2020 and 2027 and reach $8.94 trillion by 2027.

This is not to say website online banking is disappearing. According to Juniper Research, the total number of online and mobile banking users will reach 3.6 billion by 2024. However, one can’t deny the obvious domination of mobile. So why has this happened?

For many experts, it’s the COVID-19 pandemic that facilitated the growth of advanced mobile banking solutions. The pandemic created conditions that required rapid digitization of all niches and industries. Banking wasn’t an exception. People had to stay home and solve all their issues remotely, including those related to banking. Banks learned to create convenient online solutions and people learned to trust online banking transactions. With time, millions of customers realized that mobile banking is safe, effective, and convenient. This brings us to today.

Mobile banking: what awaits us in 2022?

Today, mobile banking is a must-have for every bank. The quality of mobile banking services is what makes the customer choose one bank instead of the other. In the Mobile Banking Competitive Edge Study, over 45% of respondents said that mobile is a top-three factor that determines their choice of a financial institution. So banks are doing their best to improve the quality of mobile banking apps as well as expand their functionality. They make sure their mobile services help and support customers throughout their financial journeys and strive to expand the scope of services and the convenience of these services with the help of different technologies.

Here are the trends that are expected to grow even bigger in 2022 and ensure a seamless digital banking experience for every customer.

Integration with fintech apps

When we talk about banking trends and advanced banking solutions, we often talk about open banking. Open banking enables financial institutions to make data available to anyone who has the user’s permission to access it. This is done using application programming interface (API). Through API, a bank’s mobile app pulls down customer account information and allows third-party apps to provide services useful for customers. These can be services such as budgeting, investment, credit score services, and other solutions. For example, Elinext once created an application for integration with financial organizations that would let customers apply for loans from multiple sources at a time.

In turn for providing their APIs, banks receive an additional source of income. Basically, it’s payment for renting out APIs. In the end, open banking serves everyone: banks get paid by fintech businesses, fintech businesses get paid by their users, and users benefit from the wide range of services that apps make easy and fun to use.

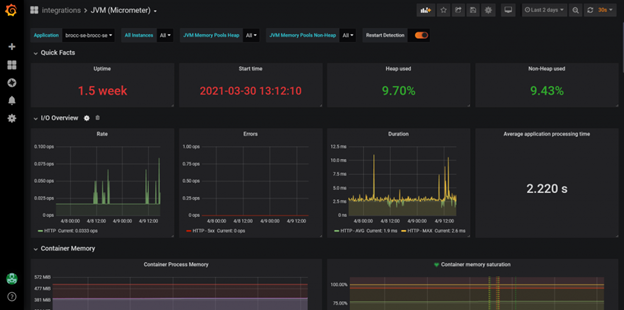

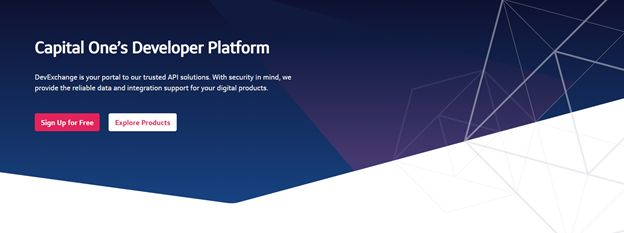

Banks can choose which information to provide through their APIs, so the extent of information depends on a bank and on a plan that developers choose. For example, the early open banking adopter Capital One created a dedicated DevExchange page where they offer a choice of four different APIs for developers.

The Spanish bank BBVA also jumped on the trend and created an API market, where they provide APIs for customer profile data, key account data, money transfer services, aggregated card purchase data, and pre-approved loans.

AI-based services

New technologies such as artificial intelligence are gradually transforming the mobile banking user experience. Banks use AI to smooth customer identification and authentication by checking their documentation and simplifying communication by creating chatbots and voice bots.

Of course, chatbots and voice bots are not yet as complex and advanced as human support personnel is. However, robotic support is improving very quickly. Every year, it becomes more and more sophisticated, and already now chatbots and voice bots can solve basic problems, answer common requests, provide the required information, and even propose new relevant products or features.

For example, the RBS’s digital AI-powered assistant called Cora can answer more than 200 basic banking queries. Cora can also have a two-way verbal conversation on screen. You can ask her verbally what to do if your card is lost, how to log in to online banking, or which mortgage would be best for you.

Another popular international bank, HSBC, has multiple chatbots which work in different locations. Their Hong Kong chatbot Amy, for example, is available in traditional and simplified Chinese and also in English. Amy continually learns and gets upgraded based on the questions she’s asked and queries she has to solve.

Greater personalization

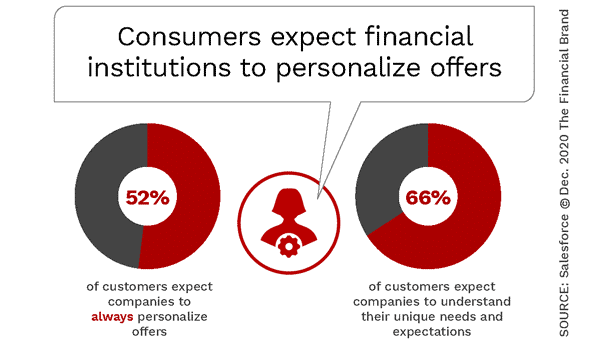

A personalized approach has been a trend in all possible industries lately, with customers expecting everyone, including financial institutions, to personalize their offers.

With the overwhelming growth of mobile banking, personalization is getting more relevant and more advanced. According to analysts at McKinsey, in 2022 banks would be using the data they have on their customers more purposefully, creating services based on purchase history and geolocation. By implementing AI, they will be processing huge volumes of data and offering products and services that the exact customer needs, much like Google or Facebook are doing at the moment. Banks are already differentiating their offers depending on the customer profile: age, profession, income level, credit history, etc. Ally Bank, for example, personalizes their campaigns according to how close their customer might be to reaching a certain milestone, like buying their first car or home, start saving for their child’s college tuition or preparing for retirement. In the future, however, we expect the targeting to become much more specific.

Outstanding design

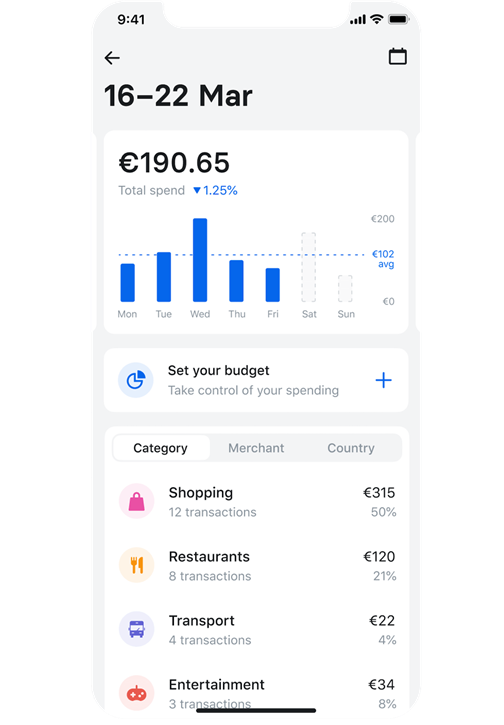

With the introduction of mobile banking services, it stopped being the “boring” industry people are forced to use. Banking apps are so convenient that people of all ages, including students and kids, use the apps. To serve Gen Zs (and please everyone else), banking apps are becoming more entertaining, more vivid, and catchier. Serious grayscale designs are taken over by animation, cartoons, Instagram-like stories, and gamification features.

One of the most frequently praised mobile banking designs is that of Revolut. Their color scheme is trendy and playful ― far from the usually minimalistic aesthetic of banking apps. Most of the images are animated. They present information in different formats like Instagram-like stories and include gamification elements like progress indicators. Revolut presents its brand as a modern view of banking, which is reflected very well in its design.

Rise of neobanks

Mobile banking and online banking are still just features of traditional brick-and-mortar banks. 2022 is expected to give a push to something completely different: neobanks. Neobanks are digital banks that are available only in a mobile app or a computer. Such banks work on tech platforms and do not have branches, can often work without a banking license, and are perfectly optimized for mobile device processes. They monetize their services by introducing transaction fees and subscriptions to premium accounts and taking commissions from third-party services. Neobanks also save on not having to rent out premises. This and the fact that the transactions and banking operations are becoming more digital than not makes neobanks a competitive force with a promising future.

Banking-as-a-Service, another innovation of digital banks, helps them to stay on top of the competition and offer all kinds of services. For example, UK-based neobank Starling Bank launched a BaaS platform in 2018, which helped them shift from exclusively B2C business to B2B. Right now, neobanks are a mostly European trend, as US regulations hold it back from taking over the US banking system. However, this is also changing, and we expect 2022 to become more friendly to neobanks worldwide.

Wrapping up

The 2020 digitization push has been affecting banks through the whole of 2021 and will still be relevant in 2022. This year won’t bring something insanely new to the world of mobile banking and banking in general, but it will exacerbate the existing trends. The trends that we’ve described in this article are answering the bigger requirements for today’s businesses, be it banking, or entertainment, or healthcare. These requirements are the following: transparency, integration, big data implementation, personalization, and not taking oneself too seriously, even if you are a bank.