Recent years have seen a boost in open source software (OSS). OSS is used everywhere and in every industry. Almost all apps are built on top of them. According to a White House briefing statement (January 2022): “software is ubiquitous across every sector of our economy and foundational to the products and services Americans use every day. Most major software packages include open-source software – including the software used by the national security community”.

The open-source trend has created a collaborative world where code lines are written and shared freely. Many enterprises in every industry have open-sourced their projects. In 2011, ExxonMobil released an open-source developer tool for the oil and gas industry. Walmart open-sourced OneOps – a platform for cloud and application lifecycle management in 2016. Four years later, Goldman Sachs announced the launch of Legend – an open-source data modeling platform based on its flagship data management and governance platform.

No industry is exempt from this technology trend, including the financial sector. The adoption of open-source banking software is a massive pillar of the current fintech revolution.

What is Open Source Banking Software?

The ongoing collaboration between the smartest minds in the world to continuously contribute and improve each piece of code has created so much technological progress. Enterprises are increasingly relying on vast open-source communities to build and maintain their products and platforms. It is estimated that 99% of Fortune 500 companies currently use OSS.

Open Source Software Definition

Simply put, Open source software (OSS) is a platform that is distributed with its publicly accessible source codes. Anyone can download the source codes behind the software. Then, feel free to inspect, modify, enhance, and share. Enterprises can leverage these available source codes as building blocks and experiment with entirely new combinations of them. It can end up creating totally new products or services on top of those codes with very little work. Or, come up with solutions that were once thought next to impossible.

Open source banking software is a platform with public codes or open application programming interfaces (open APIs). It is developed with the objective of providing a wide range of banking services and financial solutions. Open APIs can facilitate data exchange between traditional banks, financial institutions, and third-party providers (TPPs). The TPPs most often are fintech or fintech-related start-ups like neo-banks, robo advising and stock tradings, mobile payments, crowdfunding platforms, etc. By using these data, the TPPs can conduct in-depth research to gain better customer insights. Then, modify the open APIs and add extra plugins to create more relevant products and services to meet customers’ requirements.

Types of Open Source Banking Software

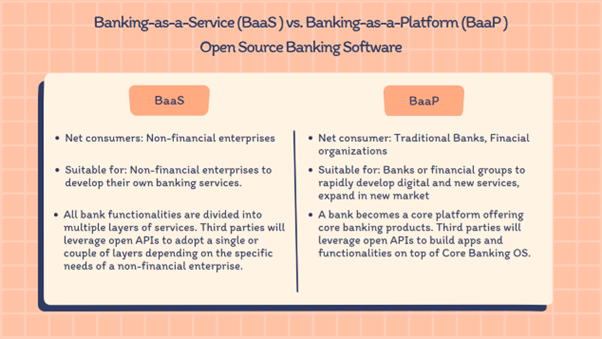

Based on the business model, open source banking software: can be divided into two types: Banking-as-a-Service (BaaS) and Banking-as-a-Platform (BaaP). Many people often confuse these two business models as the same. However, they are completely opposite.

Source: www.canva.com

● Banking as a Service (BaaS): The BaaS model is suitable for non-financial groups. These groups want to develop their own banking services such as money transfer, currency exchange, lending, etc. Normally, a traditional bank has a variety of functionalities. With the BaaS model, all these functionalities are divided into separate layers. Then, the TPPs will leverage open APIs to adopt a single or a couple of layers depending on the specific needs of a non-financial group.

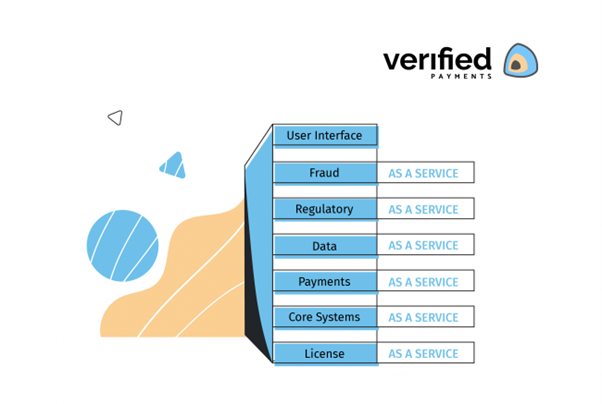

Source: https://verifiedpayments.com/

● Banking as a Platform (BaaP): This BaaP model is suitable for banks or financial organizations to rapidly offer new services or expand in a new market. The bank becomes the core platform offering the core banking products. The TPPs will leverage open APIs to build apps and functionalities on the top of the Core Banking Operating System.

Benefits and Challenges of Using Open Source Software Banking

Today, a majority of banks, financial organizations, and even non-financial enterprises are leveraging open source banking software to transform how they worked. Many of these changes can be attributed to growing their organizations, optimizing their profits, enhancing their customer experiences, and creating value for society. However, there are also some challenges needed to be aware such as vulnerabilities, license conflicts, ongoing maintenance, etc.

Benefits

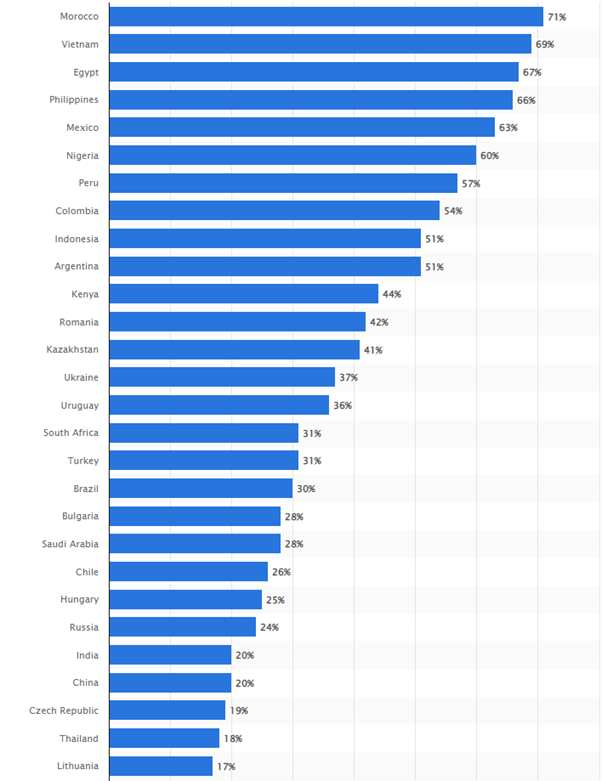

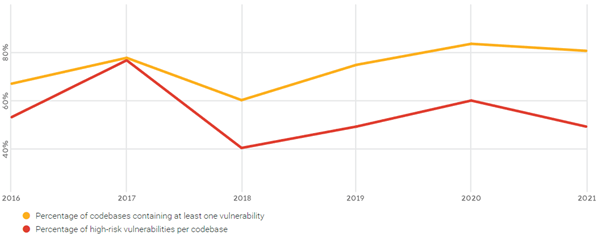

● Commoditization of Financial Services: Currently, billions of people worldwide still cannot access the services of a bank or other similar financial groups. Those people are defined as the unbanked population. The accessibility to financial services differs widely depending on the country. According to a report published by Statista Research Department, the world’s most unbanked countries in 2021 include Morocco, Vietnam, Egypt, the Philippines, and Mexico.

Source: Share of the unbanked population worldwide 2021, by country – Statista

The spread of open source banking software can help banks and financial institutions move beyond brick-and-mortar models into neo-banks and other digital platforms. It can end up delivering accessible and affordable banking services to all corners of the world. Anyone who has a smartphone with an internet connection can easily have access to the bank and conduct financial transactions.

● Cost Saving: OSS is continuously developed and maintained by thousands of unpaid volunteers around the world. Therefore, it is much more cost-effective when compared to proprietary solutions.

● Time-Saving: Utilizing the existing infrastructure lets enterprises no longer waste time on building what other businesses have already done well. Instead, they can focus on their core business and speed up the time to deliver new products and services.

● Highly Efficiency: It is estimated that around 40 million developers across the world are currently working on open-source projects on GitHub. Even if a big team of the world’s best developers cannot compete with this community.

● End-user Experience’s Enhancement: Customers, or end-users, can enjoy a variety of client-oriented financial products. Besides, they can easily operate multiple banking accounts, credit cards, investment or saving accounts in a single app.

Challenges

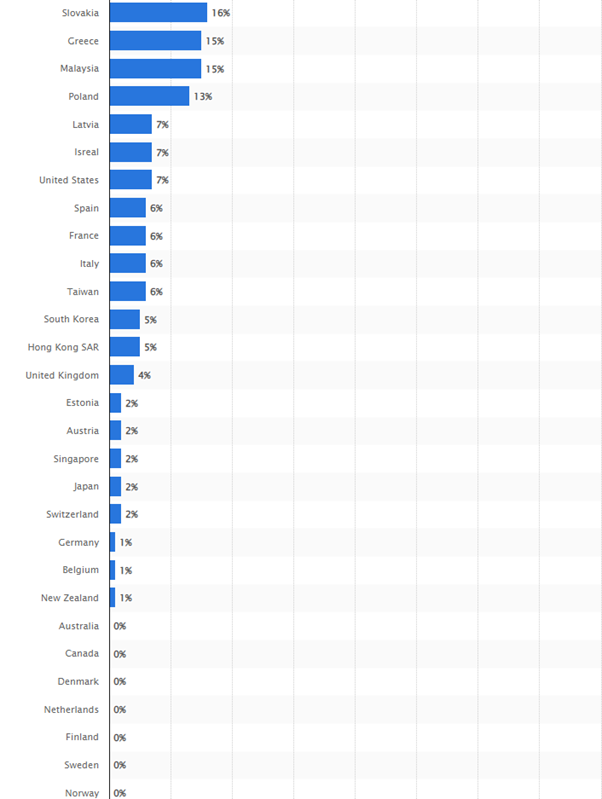

● Code vulnerability: OSS is distributed with its publicly accessible source codes making its shield more vulnerable. According to the 2022 “Open Source Security and Risk Analysis” (OSSRA) report, the overall percentage of codebases containing open source vulnerabilities remains high.

Source: 2022 Open Source Security & Risk Analysis

● Maintainance Issue: The OSSRA report also shows that 88% of codebases contain components that had no new developments and updates in the last two years. If the codebases are no longer being maintained, there is a danger of abandonment, and damaging products or services using these codebases.

● Security concerns: As mentioned in the earlier section, open APIs facilitate a process of exchanging information between traditional banks and TPPs. This raises concerns about an external breach of API or customer data security if not properly secured.

● Licensing Risks: OSS is distributed under different licenses. There are around 200 types of licenses that can be applied to OSS. Many of these licenses are inconsistent with each other. That means certain components cannot be used together. The more components are used, the more complex they become to track and compare all of the license stipulations.

The Perspective of Open Source Tools in FinTech

With the open source movement in fintech, banking has moved from something only traditional banks could offer to something that any company can do. In other words, any company can offer financial services. For example, Lyft, a ridesharing mobile app based in California, can create the Lyft Direct debit cards and bank accounts for its drivers to get paid instantly after every ride. Procore, a construction management software, can enable its construction companies, contractors, and builders to access a wide range of project financing solutions. In the not-too-distant future, every single company, even those that have nothing to do with financial services, can offer financial services as Lyft or Procone did in the past.