“There’s a way of transferring funds that is even faster than electronic banking. It’s called marriage”, used to say James Holt McGavran. But, since marriage is not always handy, developing software for international money transfers in a world dominated by digital rushing and ever-growing security threats has turned into a continuous challenge for the FinTech industry. The COVID-19 pandemic – compounded with the growing demand for fast and user-friendly digital solutions that not only reduce the ecological footprint but also ensure immediacy and user comfort – practically urged FinTech players to find solutions to improve the global money movement.

Is the remittance market causing a revolution?

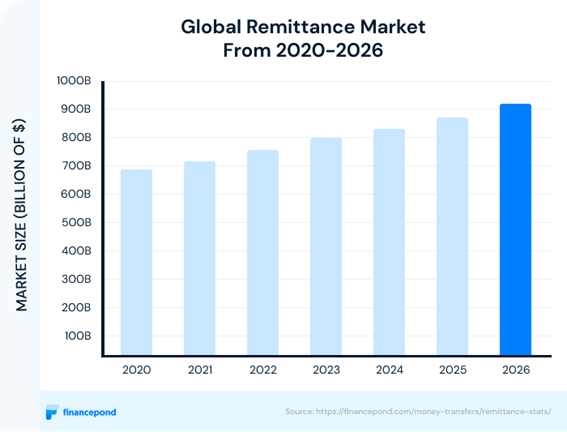

The globalized labour market and the globally connected business landscape are the two main reasons behind the boom the remittance market has been experiencing over the past years. The COVID-19 pandemic, the war in Ukraine, the decrease in fees and money transfer time, and the continuous development and adoption of digital payment solutions have fuelled the development of the sector ever further. As a matter of fact, according to Financepond, the global remittance market is expected to reach a breath-taking USD 930 billion by 2026.

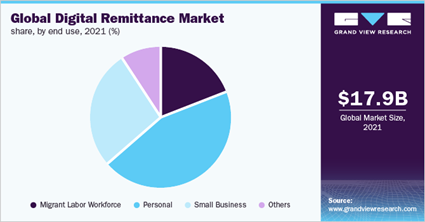

According to a report published by Grand View Research, the market was dominated by the personal segment, accounting for over 40.0% of the global revenue.

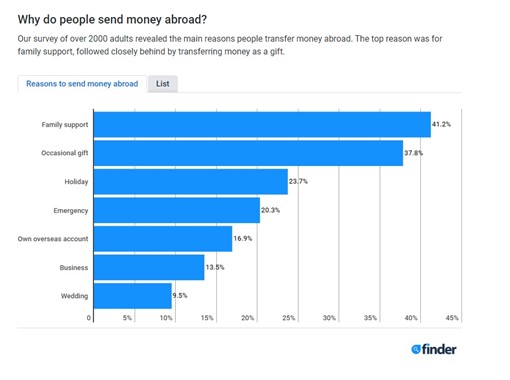

According to Finder, a UK-based credit broker, these are the main reasons people make international money transfers:

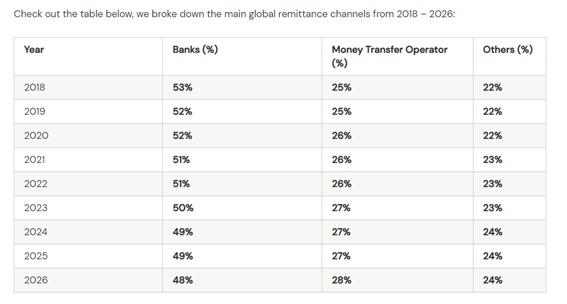

According to the same source, by 2026, banks will keep dominating the sector, channeling 48% of the funds. Meanwhile, Money Transfer Operators are expected to channel 28% of the funds.

The need for streamlined digital transactions and end-users’ willingness to adopt them are there. Let’s take a look at how the FinTech industry is responding.

Types of money transfer solutions, main features, and latest trends

The FinTech industry is more vibrant than ever before, offering innovative solutions such as in-messenger payments, payments via voice commands, or customised products. But before we get to talk more about these ground-breaking solutions, we deem it important to take a look at the main types of international money transfer software.

P2P Payment Systems

We wouldn’t be wrong to consider PayPal the symbol of this type of payment solutions. P2P (Peer-to-Peer) payments not only eliminate the need for financial intermediaries but also allows end-users to complete a transaction in the blink of an eye. Usually, everything the user needs to know is the recipient’s username, phone number, bank account, or email address. Typically, the main features of this type of software are:

- Global coverage

- Low fees

- 24/7 availability

- Fast (often instant) payment processing time

- Most apps support automatic currencies conversion

- Enhanced security features

- Ideal for a wide variety of transactions: international money transfers, payments for services and/or goods, sending or requesting money from other users, fundraising, etc.

Let’s take a look at some relevant examples:

Easy to use and flexible, this app allows users to send money worldwide in less than 24 hours (most of the time in a matter of minutes). Here are its main features:

- Offers various payment options: bank transfer, cash pickup, home delivery, or airtime top-up

- Supports over 70 different currencies

- No hidden fees

- Accepts most debit, credit, and prepaid cards (Visa and Mastercard)

- Accepts payments from Apple Pay, Klarna, Trustly, etc.

- Available for Android and iOS

- Enhanced security features

This banking app allows users to easily and safely manage money online. Once the user opens the account, he/she can opt for either a physical or a virtual card (or both!)

Main features:

- Free (with various monthly subscription plans)

- Multi-currency wallet and debit/credit card: supports up to 28 currencies

- Useful analytics and budgeting tools to keep expenses under control

- Free overseas ATM withdrawals (up to $350/month for the free subscription plan)

- Real-time currency exchange rates calculation

- Tools for buying and selling stocks, commodities and/or cryptocurrency

B2B Money Transfer Software

As the name suggests, B2B (Business to Business) transactions are carried out between two businesses and usually involve large amounts of money, recurring transactions, and – often – payment cycles that may range from 30 to 90 days. If compared to the richness of P2P available systems, B2B systems seem to be slacking. However, apart from the globally famous PayPal, there are other money transfer solutions businesses can use to control cash flow. Let’s take a look at Transpay.

Ideal for businesses that operate internationally, Transpay supports payments in 60 currencies and operates in over 100 countries. Here are its main features:

- Lower fees than bank wire

- Direct payments to bank accounts without transaction fees

- Offers direct integration with over 300 financial institutions

- Offers payments services via SFTP, APIs, web and mobile apps

- Live FX rates

What are the main mistakes while developing these services?

When developing money transfer software, the primary goal is to offer users an advantageous product that grants borderless security, seamlessness, and transparency. Here are some vital aspects to keep in mind when developing your software solution:

Make sure your software meets all the pertinent financial regulations

Regardless of the scope of your FinTech product, it must comply with all the legal requirements.

Ensure data protection

Apart from complying with all the legal requirements, using two-factor authentication is a vital security feature. Of course, the more authentication layers you offer, the more secure your customers’ data is. For instance, you can add encryption, biometric authentication, etc.

The Send/Request money feature should work seamlessly

At the end of the day, this is the main feature of your product and customers expect to be able to generate and pay invoices seamlessly. This feature is particularly important for B2B solutions.

Make sure users have easy access to payment history

Having easy access to all the completed and pending transactions is a feature that users will highly appreciate.

Ensure an enjoyable user experience

The success of your software solution depends on user satisfaction. An intuitive and attractive interface, a responsive design that is easily accessible from any type of device, multilingual and straightforward access, 24/7 customer support services, or useful functionalities such as templates or notifications, all add up toward an enhanced user experience.

Wrap up

It feels like a long time since the migration from physical financial transactions to digital ones has turned into an undeniable reality. Speed, safety, cost-efficiency, enhanced user experience. These are the key features that modern users – be it businesses or private users – are looking for in international money transfer software. Even though the existing offer is varied, developing and integrating a customized solution for your business will help you gain a competitive advantage.