While technological advancements and digitalization have been taking by storm virtually every facet of our lives, the banking industry – and most notably the payments area – seemed to be lacking that much-coveted innovative spark. In an era in which our kids can learn maths and science with the help of a robotic Professor Einstein or we have Moley cooking dinner for us, using cash, bank transfers, or cheques as payment methods looked like a retrograde step. Even if these payment methods have been digitized on the go, it wasn’t until recently that payment solutions made it into the innovative stream.

The open banking revolution

In a competitive financial services landscape focused on enhancing user experience, providing customized experiences, and reducing costs, open banking came as a breath of fresh air. As a brief definition, open banking uses application programming interfaces (APIs) to grant third-party financial service providers access to consumer banking information (e.g. account holder name, transaction history, account type, currency, etc.) Why is open banking so revolutionary? In simple terms, open banking is able to turn a passive, bank office-dependant consumer into an educated, proactive, digital consumer.

Traditional banking vs. Open banking put simple

If in the past you had to visit your bank to make a transfer or get advice on how to spend, save, or invest your economic resources, the birth of open banking has revolutionized the way we interact with our financial resources. Making a bank transfer or keeping an eye on our account balance from the comfort of our house is a breeze – as long as we are tech-literates, of course. But open banking means much more than that. Since third-party providers now have open access to all our banking data, they have practically turned into our personal, background financial advisors, providing customized investment, saving, and budgeting advice.

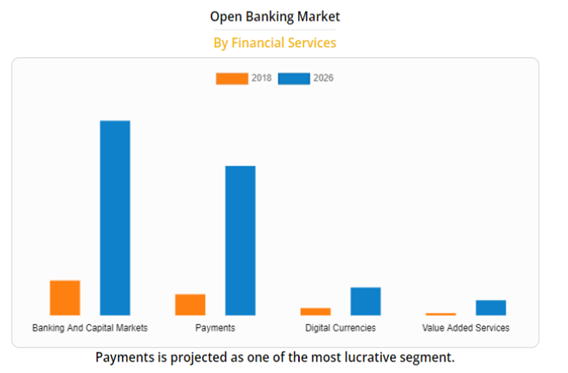

And there certainly seems to be a huge appetite for open banking, with payments being one of the prevalent segments. According to the research conducted by Allied Market Research, the global open banking market is expected to register, from 2018 to 2026, a CAGR of 24.4% and reach $43.152 million, with payments as the second most lucrative segment.

Despite the benefits it brings, open banking is facing multiple challenges. Since open banking implies manipulating a vast sensitive database, security is one of the biggest concerns that fintechs and banks need to address. Liability is another pressing concern. Open banking relies upon the collaboration between third parties and financial institutions. Without a clear legal framework, the involved parties may avoid assuming responsibilities in case of fraud, negligence, etc. Last, but not least, consumers still lack the necessary education to openly embrace open banking.

VRPs: the innovative alternative to the soon-to-be antiquated bank debit and credit cards?

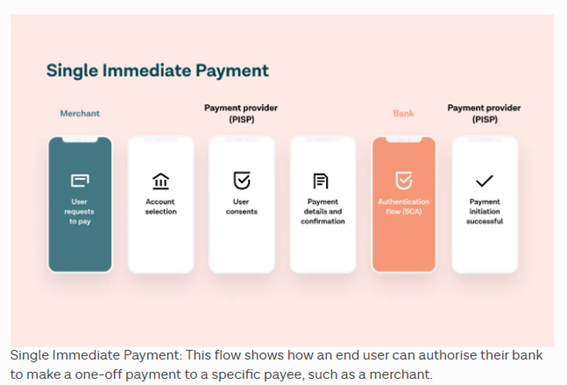

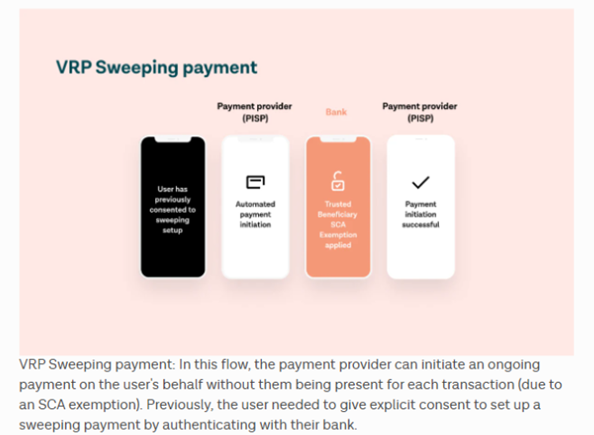

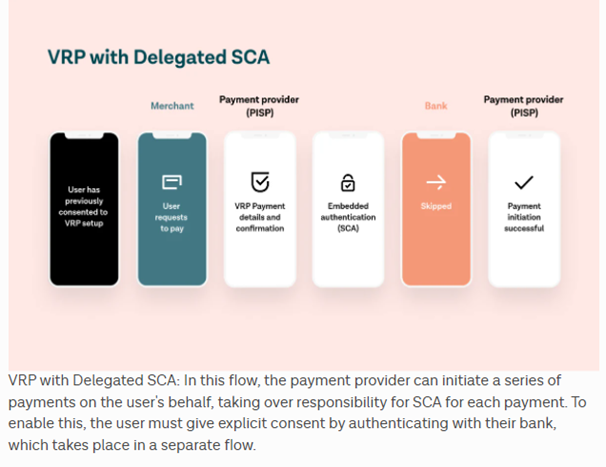

Basically, VRPs are automated bank transfers meant to streamline real-time recurring payments by eliminating the need to authorize every transaction via Strong Customer Authentication (SCA). In simple terms, what VRPs do is delegate the authentication process to third-party providers (TPPs), allowing for single-click payments for trusted suppliers. As defined by openbanking.org.uk, VRPs allow customers to securely connect authorised payments service providers (PISPs) to their bank accounts. Providers can then make a series of payments on a customer’s behalf within the agreed parameters, offering more control and transparency than most of the existing alternatives.

While it is true that VRPs are in an incipient stage and are primarily used for Sweeping use-cases (i.e. transferring money between accounts that are held under the same name), the payments landscape is undoubtedly fertile ground for further implementation. If we currently have to authorise our card payments by inputting the codes sent by text message or e-mail, VRPs will tackle this problem each time you make a purchase from your regular supplier, be it a supermarket, an app, or a phone bill. What will be in it for you as a customer apart from dodging the authentication process? You will no longer have to worry about maintaining your credit card data updated. Credit cards expire and fail. Bank accounts do not. Plus, the money will be taken directly from your account, eliminating those annoying and often confusing ‘pending’ transactions.

VRPs will not only make life a lot easier for consumers but will also benefit businesses. When a card fails during the payment process, you don’t need a crystal ball to predict the outcome: customer churn and an abandoned cart. And that translates into a missed business opportunity and a disappointed consumer. Moreover, VRPs offer other notable advantages: preventing card fraud, real-time charging, or eliminating chargebacks.

To make it easier for neophytes to understand how traditional payment methods and VRPs work, Tink offers a graphical explanation:

The adoption of VRPs at a large scale brings into discussion a pressing issue that still needs to be addressed in terms of strict regulations: customer and data protection.

Open Banking trends to keep an eye on in 2022

Will banks go into crypto to meet the growing demand?

The demand is certainly there and banks cannot afford to miss the opportunity. In fact, Visa has already launched a crypto advisory service for those merchants and financial institutions interested in attracting customers by offering innovative crypto-related products. According to Reuters, the services provided by Visa aim primarily at educating financial institutions about cryptocurrencies. What’s more, Visa is planning to launch services that will allow customers to safely operate with digital currency via its banking partners. In a business environment that is getting increasingly digitalized, competitiveness could be defined in terms of a financial institution’s willingness and ability to tackle the crypto challenge.

RtPs – will they thrive?

RtPs (i.e. Request to Pay) are an open banking solution that allows users to request payments from the debtors’ bank accounts. Especially useful for small businesses and merchants, RtPs send payers notifications about the due amounts and allow payees to easily keep track of all the invoices. RtPs – such as SEPA, BPay, or Omnibilling – offer payers the possibility to pay in full, in part, decline, or delay payment. What RtPs actually do is open dialogue between the payee and the payer, granting enhanced control, flexibility, and communication all throughout the payments process.

Even though the RtP concept is not a new one, it does acquire a greater value in the Open Banking era. Payees have the possibility to empower a payment service provider to instantly make and/or receive payments between their bank accounts and those of their customers. This approach practically eliminates the need for regular payments arrangements. Will fintechs be able to seize the opportunity and deliver ground-breaking products?

AI & Open Banking

Can things get any better? For a good while now, AI has become a game-changer in almost any industry one can think of. The banking industry just could not afford to be the exception, especially since open banking basically relies upon the relationship between different financial service providers and a huge amount of customer data. Even though one of the main reasons for introducing AI in the banking ecosystem was process automation, there is plenty of room left for jaw-dropping innovation. For instance, the use of machine learning algorithms already offers valuable insights into a customer’s spending habits, identifying potential risks and thus allowing lenders to make well-informed decisions when it comes to credit applications. Advanced fraud detection, authentication, or customer identity validation are only some of the ways AI opened its way into the banking industry. But the potential is huge. AI-powered banking solutions could take financial services to an unprecedented level of customization. In an interview for FinTech magazine, Arun Krishnan, who is Infosys Finacle’s SVP, EdgeVerve & Global Head of Engineering, was pointing out that AI will not only have a considerable impact on security, intelligent DevSecOps, adaptive operations, or self-healing systems but will also revolutionize the personal finance area. In his view, AI could mean the end of off-the-shelf financial products, allowing customers to benefit from customized loans, investments, or retirement plans. He doesn’t hesitate to say it loud and clear that, in the upcoming years, no banking area will remain untouched by AI.

To sum up

The banking ecosystem is undergoing substantial change, leaving room for steady innovation that can bring unprecedented benefits not only to customers but also to businesses and the financial institutions themselves. While traditional banking still benefits from its customers’ trust and habit-built behavior, the level of customization and convenience provided by innovative open banking solutions such as VRPs, RtPs, or AI-powered financial solutions will slowly translate into a harmonious blend between the two concepts.