According to the report provided by Aging Analytics Agency, the volume of investments in insurtech companies amounted to $7.4 billion in H1 2021, which is $300 million more than in the previous year. As for the Swiss startups, they are actively raising fundings now.

Insurtech companies provide insurers with innovative solutions that will help them gain a strategic advantage in the industry and increase revenues. The adoption of technologies powered by Big Data, the Internet of Things, Machine Learning, and Artificial Intelligence is helping the insurance industry grow with great opportunities.

Today, we will talk about health insurance technologies, their adoption by Swiss insurance companies, how they are integrating into the health and life insurance sectors, and also discuss the challenges faced by both startups and insurers.

How Do New Technologies Benefit the Health Insurance Industry?

In April 2020, McKinsey conducted a survey of insurance executives in Europe. 89% of respondents believe that modern technology will help companies drive digital sales, streamline processes, and increase the use of data and analytics to work with customers. The Covid-19 pandemic, which has caused many problems in healthcare, has accelerated the digitalization of the insurance sector.

What technologies are improving the lives of insurers and their clients?

Big Data

Big Data simplifies working processes and improves personalized experiences as it provides insurers with detailed customer information. Using this information, they can predict customer behavior, guess their wishes and requirements, thereby improving their productivity.

The Digital Consumer: Shifting Expectation and Digital Readiness report published by Appnovation shows that customers need digital experiences across all products and industries, including insurance and healthcare. People are looking for innovative solutions; therefore, life and health insurance companies must be prepared to respond to technological change and understand that usual solutions are no longer suitable.

Internet of Things

IoT has long been successfully used in the healthcare industry, especially during pandemic times, when interactions between patients and healthcare providers have become remote in many cases. Smart devices allow doctors to diagnose and treat patients remotely, help reduce treatment costs, improve patient care, and make treatment more effective. According to Insider, the IoT healthcare market will reach $158 billion by 2022.

IoT is steadily making its way into the field of health insurance as well. For example, initiatives promoting healthy habits are gaining popularity in the health and life insurance sector nowadays. Insurance companies can use wearable devices to monitor, promote healthy lifestyles (burning calories, sleeping, etc.) and support the health of their customers.

Additional data from GPS will allow insurers to track and transmit data on compliance with rehabilitation standards for applicants for disabilities. When people follow these standards, they will be able to rehab and get back to work faster, saving insurance company’s money.

Telematics

Telematics was originally used in auto insurance. Special systems monitored drivers on the roads. But health and life insurance companies began to apply telematics in healthcare, too. Telematics brings together devices that track different customer behaviors (step counting, sleep monitoring, activity level checking, and much more). The integration of telematics into wearable devices provides health and life insurers with up-to-date customer statistics. This allows them to simplify their risk profile assessment, reduce administrative costs, and lower healthcare costs. Allied Market Research revealed that the insurance telematics market stood at $2.37 billion in 2020. It is expected to grow to $13.78 billion by 2030.

Artificial Intelligence and Machine Learning

Artificial intelligence is in high demand among underwriters looking for the most advanced solutions for the most accurate risk assessment and portfolio selection. AI solutions help them choose the best insurance options, predict sales, and send personalized offers and notifications to their clients based on their digital profiles.

ML models can successfully detect situations when attackers try to deceive the insurance company by setting up an insured event. This helps insurers reduce losses and reliance on experts who investigate these events. AI solutions also help them improve customer experience through automation and responsiveness. Voice technologies and chatbots can quickly answer customer questions and provide them with the necessary assistance. McKinsey expects AI and ML products to automate 25% of the insurance sector by 2025.

Blockchain

Blockchain is a continuous chain of blocks containing information and related to each other in such a way that there is no opportunity to change or delete this information. The data ledger is distributed across many servers, enabling secure data storage. Blockchain technology is most often used as a digital register of completed transactions and contracts. For example, insurance companies can use blockchain to identify duplicate or identical payments, claims, data inconsistencies, or other signs of fraud. According to Deloitte experts, blockchain can effectively detect fraud, record, and store health records, simplify the application process, and help insurers and clients build trust-based relations.

Do Swiss Insurance Companies Need Modern Technology?

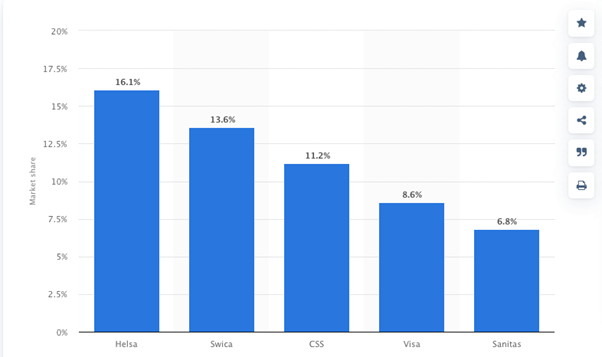

The total Swiss insurance market is valued at £52.0bn in 2020, according to GlobalData. It is predicted to grow to £54.3bn in 2023, with a CAGR of 2.1%. Statista data shows that Helsa, Swica, CSS, Visa, and Sanitas are the largest health insurance companies in Switzerland.

Source: Statista

There are 145 insurance companies in the country that compete with each other, trying to attract new customers and keep old ones. For this purpose, they need to continuously improve the quality and availability of services, meeting customer demand and offering them innovative solutions. This is the conclusion drawn by KPMG experts who believe that Swiss insurance companies should take advantage of the wide opportunities offered by advanced technologies.

According to experts, up-to-date technologies will help insurance companies increase operational efficiency, improve customer engagement, and develop useful and effective products and services. Moreover, insurers are ready for digitalization and modernization.

The 2020 GlobalData Emerging Technology Trends Survey revealed that the Covid-19 pandemic had a positive impact on insurance companies’ perception of AI-based solutions. Researchers found that 58.4% of insurers became more positive about AI during the pandemic, while 54.3% of players believe that artificial intelligence will help them cope with the Covid-19 crisis.

Barriers to Adoption of Advanced Technologies in Health Insurance in Switzerland

However, there are some issues that may prevent insurers from taking full advantage of innovation. These include the high costs of implementing and maintaining the latest solutions, the availability of qualified specialists, and legal barriers. First of all, this concerns the security of the personal data of customers.

Wearable devices, mobile apps, and other products receive and process personal data. Therefore, they must comply with both local laws (for example, the Federal Law on Human Genetic Testing, the Human Research Act, and the Federal Data Protection Act) and European ones (for example, the General Data Protection Ordinance).

When creating digital products for health insurers, developers must pay particular attention to data protection and cybersecurity as hackers hunt for sensitive information. When choosing a development software company, health and life insurers should make sure that it will be able to provide an appropriate level of protection (e.g. by using various methods like data encryption, two-factor authentication, access control, and more). Of course, these solutions should be easy-to-use and high-performance.

If you want to learn more about health insurance solutions or need some help in choosing a reliable developer, Elinext experts are here to answer all your questions.